Donald Trump is Lying. He Wants to Destroy Social Security and Medicare

When he was running for President in 2016, one of the things Donald Trump tried1 to emphasize was that he was different from other Republicans: he would protect Social Security and Medicare. He then won the election and spent the next four years as President, where he relentlessly attacked the foundations of these two vital programs. Now, four years later, he is running for President again, and although his rambling is less coherent than ever, he does seem to again be telling his supporters that he will protect these programs. The only problem is that the policies he and his supporters have outlined with destroy them.

Contradictory Campaign Rhetoric

This is Trump's fourth official Presidential campaign. In each, he made preserving Social Security a cornerstone of his rhetoric.

In 2000, when a combination of tax increases and smart management by the Clinton administration had the country on a path of persistent2 surpluses, Trump proposed a one-time wealth tax on the richest Americans to fully pay off the debt, allowing some of the money that was being spent on interest payments to go to Social Security. At the same time, he called it a "Ponzi Scheme," backed privatization, and supported raising the retirement age.

In 2016, he was even more explicit about his supposed support for Medicare and Social Security. Before he had even descended his golden elevator and officially launched his campaign, Trump differentiated himself from his fellow Republicans by promising not to cut Social Security or Medicare:

I'm not gonna cut Social Security like every other Republican, and I'm not gonna cut Medicare or Medicaid. Every other Republican is gonna cut, and even if they wouldn't, they don't know what to do, because they don't know where the money is. I do.

When he officially launched his campaign, he was equally strident,

The government must honor its obligations to our seniors. We must protect Social Security, Medicare and Medicaid, without cuts...there will no longer be any waste, fraud and abuse on my watch.

During the campaign, however, the decisions he made contradicted these statements. First, by choosing as his running mate Mike Pence, who was characterized as "one of Congress' most aggressive Social Security privatization supporters" by the National Committee to Preserve Social Security and Medciare during his time in Congress, Trump demonstrated that his shallow commitment to these vital programs. After all, "Personnel is Policy."

Further demonstrating his weak commitment to these policies, the Republican platform called for cuts to both Medicare and Social Security. On Medicare, the platform proposed drastic cuts for all Americans born after 1961, going as far as to increase the age of eligibility:

That is why we propose these reforms: Impose no changes for persons 55 or older. Give others the option of traditional Medicare or transition to a premium-support model designed to strengthen patient choice, promote cost-saving competition among providers, and better guard against the fraud and abuse that now diverts billions of dollars every year away from patient care. Guarantee to every enrollee an income-adjusted contribution toward a plan of their choice, with catastrophic protection. Without disadvantaging present retirees or those nearing retirement, set a more realistic age for eligibility in light of today’s longer life span.

On Social Security, the platform was less explicit in cuts, but it emphasized changes, saying that while "all options should be considered," any that increase taxes, like raising the cap on taxable income, should be rejected.

While it important to note that party platforms are largely unimportant documents, it is striking that the Trump campaign, with its supposed focus on preserving these programs chose to excercise its influence on blocking language supporting Ukraine in preserving its territory from Russian incursions, rather than keeping support for cuts to these programs out.

In his 2020 campaign, he often claimed he would support Social Security and Medicare. For example, in September of that year, he tweeted, "I will ALWAYS protect Seniors and your Social Security!" Similarly, he made bold claims about his support for Medicare,

As long as I am President, no one will lay a hand on your Medicare or Social Security. As a candidate, I made a sacred promise to strengthen, protect, and defend your Medicare benefits, and that's exactly what I've done. I've done that, right?

At the same time, the party controlled adopted the exact same platform from 2016, with its support to cut Medicare and Social Security. Also, in off-script moments he was happy to talk about cuts. In a Fox News town hall, in response to a question about the role of entitlements and the debt he said, "Oh, we'll be cutting."

This time around, Trump has again used his supposed support for Medicare and Social security as a key argument for his candidacy. In his attacks on DeSantis' campaign, Trump used the Florida governor's past support for Medicare cuts as a cudgle against him.

This rhetoric, however, flies in the face of his record and some of the proposals he and his supporters have made. In 2016, he embraced the idea of Medicare negotiating drug prices, however his administration did not implement that policy. The Biden administration, however, through the Inflation Reduction Act (IRA) has.

That means that Medicare today includes negotiation with Pharmaceutical companies over the prices they charge. Team Trump, however, has had not compunctions about weakening Medicare by removing it. Many members of his circle were more than willing to spell out to Axios how a second Trump administration would use its power to enforce laws to minimize the amount and competence of negotiations, while the supposed playbook for that administration, Project 2025 is more explicit, "This 'negotiation' program should be repealed."

In addition to Trump's extremely contradictory campaign behavior on Medicare and Social Security, his record as President was worse.

His Record as President

The four years of the Trump administration were nothing short of a sustained attack on the foundations of Medicare and Social Security. Each Budget he proposed included drastic cuts to Social Security, and in his later ones he also proposed Medicare cuts.

Attempted Budget Cuts

| Budget Proposal | Medicare Cuts | Social Security Cuts |

|---|---|---|

| FY 2018 | $236 Billion | $72 Billion |

| FY 2019 | $550 Billion | $72 Billion |

| FY 2020 | $845 Billion | $84 Billion |

| FY 2021 | $500 Billion | $76 Billion |

Many of these Social Security cuts were to Social Security's disability insurance (SSDI) program. While this program is a vital source of income to Americans unable to work, it has also come to serve another crucial role: as a catchall for the holes left in America's inadequate welfare state. For example, in regions most hurt by trade competition, more than 99 percent of increased welfare payments came through SSDI rather than Trade Adjustment Assistance3.

To justify the lie that the Trump administration did not attempt to cut Social Security, his former budget director, CFPB Chair, and acting Chief of Staff Mick Mulvaney said SSDI was not what people think of when they think of Social Security4, a blatant lie.

Similarly, the Trump administration claimed that because the proposed cuts were to aspects of the program other than direct benefits, they were not Medicare cuts. This was another lie. Especially in light of the other policies his administration pursued.

One way this revealed itself was in the Trump administration's continued attempts to undo the Affordable Care Act (ACA). Despite the failure of its legislative attempts, his Justice Department endorsed legal efforts to find the entire piece of legislation unconstitutional.

The ACA introduced a plan to close the coverage gap for prescription drugs. By 2016, this provision of the law had saved 11.8 million Medicare beneficiaries $26.8 billion. Despite this fact, the Trump administration made no plans for these beneficiaries in the event their efforts to undermine the ACA proved successful. In fact, his FY 2020 budget would change the formula for how out of pocket expenses were calculated, making it harder for seniors to reach their catastrophic coverage limit.

In addition to undermining the benefits provided by Social Security and Medicare, Trump seemed borderline obsessed with eliminating their primary sources of revenue: payroll taxes.

Obsession with Payroll Tax Cuts

With the exception of Medicare Part D, created as an unfunded program by the Bush administration in 2003, Medicare and Social Security are funded by Payroll taxes. For Social Security, these taxes are 12.4 percent (10.6 percent to old age survivor insurance and 1.8 percent for SSDI) of income under $168,600, while Medicare is 2.9 percent of income under $200,000, and 3.8 percent of income over $200,000. When these taxes yield more revenue than these programs cost, the extra goes into a trust fund5, and those trust funds cover shortfalls when the taxes yield less. This revenue serves to protect Social Security and Medicare from political pressure, because they will get that funding regardless of what the White House and Congress say5.

Naturally, therefore, Trump seemed totally committed to eliminating payroll taxes in one form or another. During the economic decline in 2019 that right-leaning economic commentators have conveniently forgotten about, Trump confirmed that his white house was working on proposals for payroll tax cuts, which would deprive Social Security and Medicare of the revenue they need to function.

Then, as it became clear that the Pandemic would have devastating economic consequences, Trump demanded a short-term payroll tax cut. His motivation was clear, as he told Senate Republicans, he wanted voters to make their decisions based on larger paycheck numbers. Never mind that in practice, a payroll tax cut would take six months to implement and create a significant burden on employers.

Furthermore, as unemployment spiked by more than ten percentage points, a payroll tax cut would provide no benefit to the unemployed, who by definition do not have paychecks for payroll taxes to be taken out of. Therefore, his payroll tax cut did not make its way into the pandemic response legislation.

Unfortunately for many Americans, Trump was not done. In August of 2020, he announced a poorly thought out Payroll tax deferral. Those who took the deferral would then have to make up the payments later. Therefore, few employees voluntarily signed up for it, however, he did order members of the Armed Services to take the deferral, cutting their post-election paychecks. Furthermore, he laid out his intention to--at a minimum--permanently cut revenue for Social Security and Medicare in half:

If I'm victorious on November 3rd, I plan to forgive these taxes and make permanent cuts to the payroll tax. So I'm going to make them all permanent.

The effect of this tax cut would be to add an expenditure worth roughly 5 percent of GDP, roughly doubling the annual deficit. This doubling would, however, require legislative change. Currently, if the combination of payroll tax revenue and trust fund balances are insufficient to meet all of the requirements for a program, then payments will be curtailed across the board in relation to the shortfall. For example, if the Social Security trust fund was empty and payroll tax revenues were only sufficient to meet 75 percent of the payment obligation, payments would be reduced by 25 percent. So if Trump were successful in cutting payroll taxes permanently, he would need to take some combination of four approaches: increasing taxes, cutting discretionary spending, allowing debt-financing of Social Security and Medicare, or dramatically cutting benefits.

Given the preponderance of Congressional Republicans who have signed Grover Norquist's sinister pledge to oppose any increases in marginal tax rates or any net reductions in deductions and credits, the likelihood of Republican-led tax increases in any way are extremely low. Spending cuts could not come close to covering the cost of Social Security and Medicare, as they are larger than the discretionary budget. Debt-financing is possible, but while the panicking of deficit scolds has been generally unfounded in recent decades, a dramatic increase in the pace of borrowing when the national debt is already approaching a record size would probably not be economically beneficial. That leaves dramatic benefit cuts.

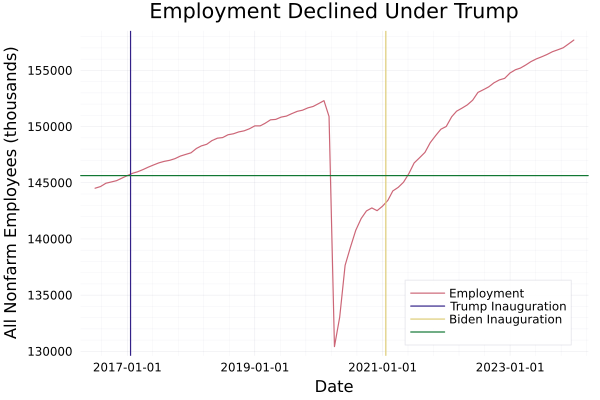

While the exact approach Trump would take is not clear, it seems that the only thing preventing him from enacting this harmful denial of revenue to these programs is his general incompetence. Unfortunately, that is a double edged sword, as his general incompetence was also responsible for him reducing the flow of revenue to these programs in one meaningful way: he left office with fewer Americans employed than when entered:

There is, however, some insight as to how Trump would want to deal with the response to a cut in payroll taxes. He was fairly open about his desire to cut Social Security and Medicare as soon as he no longer had to answer to the voters.

Constant Talk of Cutting Medicare and Social Security

In January of 2020, while giving an interview with CNBC's Joe Kearnen at the World Economic Forum in Davos, Switzerland, Trump came right out and said that he planned to "look at" cuts to Medicare and Social Security in a second term:

Kernen: "One last question. Will entitlements ever be on your plate?"

Trump: "At some point they will be, we have tremendous growth, we're going to have tremendous growth. This next year I, it'll be towards the end of the year, the growth is gonna to be incredible, and at the right time we will take a look at that--that's actually the easiest of all things, if you look, because its such a big percentage..."

Kernen: "If you're willing to do some of the things that you said you wouldn't do in the past, though, in terms of Medicare, in terms of ..."

Trump: "We're gonna look. We also have assets that we've never had. I mean we've never had growth like this, we never had a consumer that was taking in--through different means--over $10 thousands a family, we never had the kind of things we have, look, our country is the hottest in the world. We have the hottest economy in the world, we have the best unemployment numbers we've ever had. African American, Asian American, Hispanics are doing so incredibly, best they've ever done. Black, best they've ever done, African American, the numbers are incredible. The poverty numbers, the unemployment and the employment--there is a difference actually, but the unemployment and the employment numbers for African Americans are the best we've ever had. You know we just came up with a chart, and it was a very important number to me: African American youth has the highest by far unemployment, the best numbers they've ever had, and the best employment numbers--right now we have almost 160 million people, working in the United States, and we've never even been close to that Joe."

Cutting through the nearly incoherent rambling and bald faced lies about the state of the economy at the time, one thing is abundantly clear: in January of 2020, Trump was open about plans to cut Social Security and Medicare in his second term. Combing that with his March 2020 promise, "Oh, we'll be cutting," his continued embrace of personnel who would undermine these programs, and his record as president of trying to cut off different funding tools, it is safe to say that a second Trump term would involve, at a minimum, substantial attempts to undermine Medicare and Social Security.

Those are the stakes in the 2024 election. A continuation of the Biden administration that has protected, expanded, and improved Social Security and Medicare, or a second Trump administration that would involved repeated attacks on them. I know which one I will be voting for in November.

Footnotes

Emphasis on tried because even then he struggled to string a coherent sentence together.

Even at the time, there was some understanding that demographic pressures would eat away at these surpluses as baby boomers retired. Notably, this was a core of Vice-President Gore's campaign.

see Hanson, G. "Economic and Political Consequences of Trade-Induced Manufacturing Decline." In Meeting Globalization’s Challenges: Policies to Make Trade Work for All. 2019.

CBS News, 2017-03-19

While the trust funds are just notations in the Treasury General account, they are protected in certain ways. That is why during government shut downs, Social Security checks still go out and Medicare still works.

Technically, Congress could pass legislation restructuring and diverting this funding, but that would be a Herculean political task.