Joe Biden for President in 2024

In 2016, the New York Times broke with their normal precedent to come out against the candidacy of Donald Trump before listing their affirmative case for Hillary Clinton. When they came out for Clinton, while the endorsement builds an affirmative case, it is littered with the caveats endemic to those elites who have decided it undermines their credibility with a--nonexistent--population of reasonable and respectable conservatives to enthusiastically support any Democrat. I have no such concerns. And that is why I can say that I will be enthusiastically voting for Joe Biden this November. His record of competence these last three years has already vaulted him into competition for the best President of the last six decades, and if we as a party are able to elect Congressional majorities (an admittedly Herculean task given this year's Senate map), I see nothing to stop him from strengthening that claim.

A Record of Accomplishment

When President Biden took office, the country was in a bad place. While the unemployment rate had dropped from its April 2020 high of 14.8 percent, the increase in employment had dropped off after October of that year, with 6.4 percent of the labor force still unemployed. This number understated the scale of the unemployment problem, as the labor force participation rate, which had been 63.3 percent before the pandemic, had fallen to 61.3 percent. Taking that into account, more than ten percent of the labor force were unemployed as President Biden started his new job.

At that time, the CBO projected1 a sequence of unemployment rates that would see it take more than a decade to get to the 2019 average unemployment rate of 3.7 percent.

| Year | CBO Projection | Actual Annual Average |

|---|---|---|

| 2021 | 5.7 | 5.4 |

| 2022 | 5.0 | 3.6 |

| 2023 | 4.7 | 3.6 |

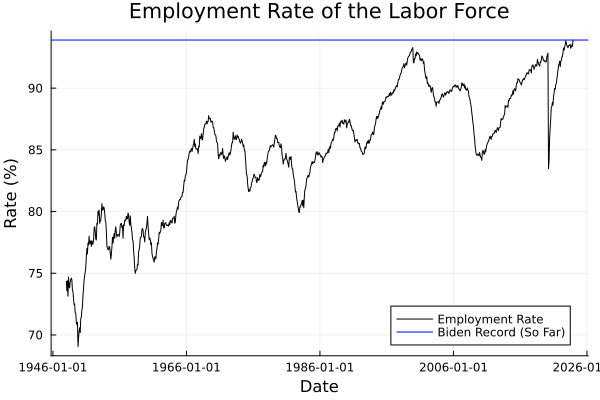

Instead, under President Biden's leadership the labor market has created more jobs than could have possibly been imagined at the time, with the only two years with below 3.7 percent average unemployment since the 1960s. The increase in labor force employment has been even more striking, with the December 2023 reading of the number of nonfarm employees as a percentage of the labor force reaching the highest level it ever has.

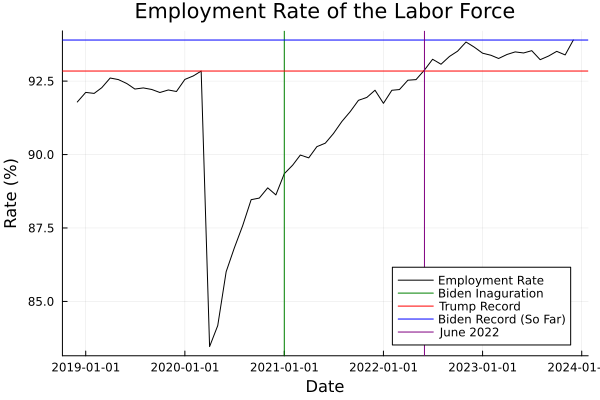

Zooming in to the past five years, the scale of what the American labor market has achieved under President Biden is just as striking. For more than a year, a higher percentage of the labor force has been employed than at any point during the Trump presidency.

While it would be a fool's errand to precisely assign this strength to specific policy actions, it would be even more foolish to discount the role of policies pushed by the President in supporting this strength. Specifically, the active White House involvement in the passage and implementation of: the American Rescue Act, the roll out of the vaccine, the Infrastructure Investment and Jobs Act, the CHIPS and Science Act, and the Inflation Reduction Act all made for a much better country than the one he was elected President of. With the possible exception of the vaccine roll out, I will be writing more in depth pieces on each of these. Still, it is worth going over some of the headline benefits each was able to put in place.

Before doing that, however, it should be noted just how thin the congressional majorities President Biden enjoyed in the first two years of his Presidency. Even thinner when one of the Senators whose vote he needed has since left his party, and the other is actively considering a presidential run on a ticket backed by an orginization that opposed the January 6th Committee in the name of "bipartisanship."

While his legislative record is far stronger than I have made out here, with legislation closing loopholes for gun purchasers and providing care for veterans exposed to "burn pits," this piece is already too long, and I don't want to overwhelm the reader with a wall of facts.

The Vaccine Roll Out

While one of the few areas in which the Trump administration will be credited by history will be the fantastic success of "Operation Warp Speed," his personal desire to downplay the virus forced the conservative media ecosystem to shift into full covid-skepticism well before the vaccine could be approved. As a result, he refused to promote the vaccine publicly, and was vaccinated in private.

President Biden showed no such cowardice. He was publicly vaccinated before he even took office, and made the roll out of the vaccine a top priority. With the policies he pushed, we as a country were able to blow past his initial goal of 100 million doses in his first 100 days to more than 200 million doses.

Despite concerted opposition from much of the right wing information ecosystem, Biden's policies have led to a sufficient vaccination to keep the toll of all subsequent infections well below the peak reached at the end of February 2021, even as people have been able to return to normal life without many of the restrictions that were previously imposed.

The American Rescue Act (ARA)

Claudia Sahm is fond of calling the ARA the best piece of macro public policy in the last fifty years, and while I would not go that far, it has been forgotten how important that legislation has been to the best things that the government has done in the past three years. Despite negotiations with Manchin and Sinema stripping some important aspects of the original legislation away, it was still momentous legislation that provided the demand side investment necessary to get the economy back to full employment faster than almost anyone had predicted.

Continuing on the success of the CARES Act, the headline feature of the ARA was making good on President Biden's pledge to get working and middle class households the rest of the $2,000 they had been promised. In fact, the benefits to the households that make up the backbone of the economy were substantial enough to totally erase the tax liability of taxpayers making less than $75,000 per year. Furthermore, as part of his emphasis on making sure that the jobs worked by Americans paid what they were worth, the legislation extended supplemental unemployment benefits, so that companies had to offer competitive wages to lure workers back.

The legislation, however, went beyond getting cash to Americans who needed it as quickly as possible. It also included major investments in getting the country back to where it needed to be.

Much has been made in the intervening years about the decisions to send kids home from schools. Unfortunately, it has been forgotten that one of the reasons kids were able to get back into schools as quickly as they were was thanks to the $130 billion allocated towards making them safer in the ARA. This included the largest ever investment in childcare, and an extension of the pandemic era child tax credit that led to a 50 percent cut in child poverty.

While older Americans were effected much differently than children, the burden of the pandemic fell similarly upon them. The ARA provided more than $100 billion to protect them, including: more than $12 billion to facilitate in-home rather than in-facility care, a boost to federal contributions to Medicaid home and community-based services, boosted funding for Elder Justice Act enforcement, and $86 billion to sure up multiemployer pension funds that had been undeserved by their corporate stewards.

Importantly, the ARA learned major lessons from the response to the global financial crisis from 2007-9. In its aftermath, state and local governments--which are often required to run balanced budgets--had to cut spending or raise taxes in order to meet their statutory requirements. This fiscal austerity, especially after the federal government stopped pursuing an expansionary macroeconomic policy in 2010, greatly slowed the recovery from that recession and contributed to the massive shortfall in infrastructure President Biden faced when he took office. The ARA, therefore, provided $350 billion to state and local governments. While some ethically questionable state governments, like Florida's, spent their money on boondoggles like a high-end hotel with an 11,000 square foot spa, it still proved vital to supporting the return to normal.

The Infrastructure Investment and Jobs Act (IIJA)

While the sorry state of American infrastructure can partially be blamed on the lack of investment by state and local governments constrained by their budgets over the preceding decade, they alone cannot shoulder most of the blame. President Biden's predecessor, who promised an "infrastructure week" seven times, managed to do little more than freeze EPA water system improvements.

With notable support from a limited number of Republicans, President Biden was able to pass the IIJA, a $1.2 trillion piece of legislation addressing many of the nation's infrastructure shortfalls. As any infrastucture legislation must, it included more than $100 billion for roads and bridges, but unlike many similar pieces of legislation put forward in the two decades before it was passed, it went much further.

After decades of inaction on the scurge of lead pipes, the IIJA provided $15 billion to mitigate existing lead pipes. Given the high rate of job creation from water utility spending (15-18 jobs per million dollars spent), this spending--in addition to safeguarding the brain development of America's children--created more labor demand. As provisions of the IIJA had strict union and prevailing wage requirements, this job creation would actively increase labor power, and refortify the middle and working classes.

The CHIPS and Science Act

This CHIPS and Science Act took note of a stark reality. Semiconductors, as some of the most important components in all manner of vital products are a major bottleneck to the economy of the 21st century. The Chinese Communist Party is well aware of this fact, and has taken steps to ensure the dominance of China in that industry. In order to ensure that this does not come to pass, it is vital to provide financing to spur changes that will lead to a powerful American semiconductor industry.

This was so seemingly uncontroversial that its signing ceremony was able to draw "a crowd of hundreds, including tech executives, union presidents and political leaders from both parties."2 Despite the uncontroversial nature of the legislation, earlier versions of the legislation failed to pass in 2020.

The Inflation Reduction Act (IRA)

Arguably the most significant piece of legislation signed by President Biden, the IRA did three things that would have seemed unthinkable to the most hardened Washington insiders POLITICO could find to interview in a preview article as the Biden Administration took shape:

- Real Tax Increases on Corporations and the Wealthy

- Major Health Care Reforms that Lowered Prices for People and the Government

- The Largest Climate Investment in History

All of this was accomplished while reducing borrowing.

The first real tax increases on corporations and the wealthy (rather than expirations of temporary tax cuts) this century had three pillars: an alternative minimum tax on the largest corporations, a tax on stock buybacks, and real enforcement of existing tax laws.

In 2023, a single American taking the standard deduction would pay 15 percent of their income in federal taxes with around $74,000. Unfortunately, many of the largest corporations pay much less. To combat this, the IRA included a minimum tax rate of 15 percent on all corporations that book a minimum of $1 billion in profits over a three year period.

In the widely accepted (and mathematically elegant) Modigliani-Miller theory of corporate finance, there is no difference between buybacks and dividends. In the real world, however, the differences were stark. Dividends are taxed as income3, while buybacks are only taxed as the realized capital gains of those who are selling shares to the company, if those shares were held in a taxable account. To partially address this inefficiency, the IRA introduced a nondeductible one percent tax on buybacks that covered 21 percent of the previous difference.

Finally, the IRA addressed a decade of neglect in IRS funding, a decade that had left the agency unable to pursue the most complex tax fraud cases. This forced the agency to avoid confronting the rampant tax evasion by the wealthy. Two facts bear this out: in the years before the IRA was passed, the IRS was as likley to audit recipients of the EITC as it was to audit households in the top one percent; and by 2019, 64 percent of the deficit, $630 billion, could be counted as taxes avoided.4

This revenue gave the government serious latitude to pursue policies and investments that would directly benefit the American people. While this will mostly be expanded upon when I get to the climate investments, it is how the legislation was able to extend ACA subsidies through 2025.

In addition to the ACA subsidies, the IRA finally freed Medicare to use its market power as the largest health insurer in the market to get benefits for its clients: seniors. Finally, Medicare, like every private insurer, was allowed to negotiate drug prices with pharmaceutical companies. This benefit will likely trickle down to those of us on private insurance, as they will set a new market standard.

In addition, the out of pocket price of insulin to seniors was capped at $35 per month. While Republicans were able to strip out the portion that brought that mandate to all Americans, the Medicare price will still serve as a powerful market signal. In fact, all out of pocket drugs covered by Medicare Part D5 will be capped at $2,000 a year.

These expensive programs were paid with minor increases in taxes on corporations and the wealthy. As was the largest climate investment any country has ever made. This included billions to address the impacts of sever weather, tax credits to make housing more resilient, and greenhouse gas mitigation. It also put the country on a pathway to energy independence by finally opening up our EEZ to offshore wind farms, and subsidizing the development of advanced clean energy manufacturing, especially in areas that are currently dependent on the least efficient coal plants.

Climate Power has been tracking the resulting clean energy boom, which has persisted despite the increase in interest rates over the last year.

Surprising Resilience

Despite these accomplishments, President Biden has faced many hostile institutional foes that I expected to hamper him more. The biggest of these is the judiciary. Strategic planning and a ruthless contempt for political norms allowed for Republicans to install many young conservative activists on the bench at all levels of the Federal judiciary. These activist judges have made it their mission to hamper as many of his policy goals as possible. In the face of adverse rulings, however, President Biden has not backed down.

The canonical example of this can be seen in the Supreme Court's disgraceful decision to block his student debt forgiveness program. Rather than be cowed by this decision, the Biden administration has pushed relentlessly along two tracks: developing a new comprehensive plan under the Higher Education Act, and exploiting every bit of exiting statutory authority in existing forgiveness plans to forgive as much debt for as many borrowers as quickly as possible. This has led to millions of borrowers seeing billions of dollars of their debt being forgiven.

While the judiciary has been his most formidable institutional opponent, it has not been his only one. Since he took the hard decision to bring our troops home from Afghanistan, there has been a decisive turn in major media outlets against his administration. This turn has been alternately subtle and blatant, but he has stayed focused on the most important part of his job, delivering for the American people.

A key example of this has been in the persistence of stories whose main thesis is that he is old. In truth, he is, but, barring a major surprise, the President being sworn in on January 20, 2025 will have been born before Harry Truman won a Presidential election in his own right. In that 1948 campaign, the candidates traveled the country in rail cars, as the interstate highway system and jet planes were still years away from having a major impact on the daily lives of the Average American. That seems astounding, and it does not sound right. Moving beyond the tired talking point that Joe Biden is old, however, a major difference between the two old candidates must be noted (And it isn't the alarming decline in Trump's already tenuous mental faculties, I will address those in another post later): Joe Biden looks forward to an optimistic future, while Donald Trump looks back to a nonexistent past.

Through the policies he has enacted, Joe Biden is looking forward to an America with a strong middle class, supporting the industries that will power the future. Donald Trump, his likely opponent, hearkens back to a mythical time when America was "great."

I want to move forward, to the bright future that Joe Biden is building. That is why I will be voting for him in the DC primary and November general election.

Footnotes

While I have many issues with specific aspects of the CBO's model, it is well respected.

CNBC, 2022-08-09

This is slightly more complicated due to the difference between qualified and non-qualified dividends, tax-advantage retirement accounts, and deductions for foreign owners of Americans shares, but for the sake of this article, it is basically true.

I know that there is a difference between tax avoidance and tax evasion, but I am not coming at this from the perspective of a tax lawyer.

Unfunded mandatory spending signed by George W. Bush to cite any time a Republican makes a claim of fiscal responsibility